Liebreich Newsletter: Trade, hydrogen and…COP26!

Trade, hydrogen and…COP26!

I started drafting this newsletter during the summer, and then suddenly COP26 came and went. I have been so busy since my April newsletter that it has become something of a long read. I do apologise in advance – if you feel tired reading it, imagine how I feel. Roll on Christmas, I say!

COP26

After two years of preparation – an extra year due to Covid – COP26 was suddenly on us.

In the week before it kicked off I published a piece for BloombergNEF entitled Let’s Toast Glasgow, even if we’re toast, in which I predicted that COP26 would be a huge success despite failing to get the world on track for 1.5C of warming. And so it turned out to be.

Glasgow was really three separate COPs: the COP of the negotiators, which was a tremendous achievement (congratulations Alok, don’t let anyone talk down your contribution), despite the language around “phasing down” rather than “phasing out” coal; the COP of the activists, which presented a narrative of total and complete failure that is at increasing odds with reality (since we now know that emissions peaked around a decade ago); and the COP of the doers – the businesses, investors, innovators, mayors, ministers and social entrepreneurs with whom I spent COP – who are moving at a speed that is on track to outstrip the negotiators and prove the activists excessively pessimistic.

Overall, Glasgow was a fantastic demonstration of the power of the Paris Agreement, securing net zero pledges from almost all of the major emitters and spurring a huge increase in ambition that gets us under 2C of warming if it is followed up by action. At the same time, however, Glasgow also made it clear, even if we don’t want to admit it yet, that we are approaching the moment we have to admit that 1.5C is unattainable.

For more of my thoughts on COP26, listen to this conversation with Guy Turner, CEO of Trove Research, former Head of Carbon and Chief Economist at New Energy Finance and BloombergNEF, or the upcoming episode with David Sandalow, former acting U.S. Under-Secretary of Energy and expert on the China U.S. relationship which was so critical to the success of COP21 in Paris and COP26 in Glasgow.

My COP26

As described in my last newsletter, in the depths of lockdown I had a crazy idea: rent a historic castle just outside Glasgow – belonging to Charles Hendry, former UK Energy Minister and his wife Sallie – and convene two weeks of high-level discussions on the knottiest issues standing in the way of climate action.

By January, I was pretty confident of three things: the vaccines would work; Boris Johnson would insist on an in-person COP; and Glasgow did not have enough quality venues for productive side events. And lo, the Climate Action Solutions Centre (CASC) at the Blair Estate was born.

|

| For COP26, I put together a consortium consisting of Liebreich Associates, National Grid, Octopus Energy and the Atlantic Council rented the historic Blair Estate outside Glasgow. The Climate Action Solutions Centre hosted 11 days of high-level discussions with senior decision makers. Amazeballs. |

By March I had put together a consortium consisting of Liebreich Associates, National Grid, Octopus Energy and the Atlantic Council (Quadrature Climate Foundation was also an early and vital supporter). The next eight months were a real roller-coaster, as we were rocked on a weekly basis by news and rumours of new Covid variants, travel embargos, isolation boundaries around the Green and Blue zone and so on.

But we held our nerve, and CASC was a stunning success. We ended up hosting 11 days of discussions at the Blair Estate and a number of events in Glasgow. The list of participants included Malcolm Turnbull, Tom Steyer, Anne-Marie Trevelyan, Tom Vilsack, Nancy Pelosi, Eamon Ryan and about 800 other ministers, CEOs, C-suite executives, senior investors, civic society and academic leaders. Themes included renewable energy, nuclear power, hydrogen, electrification of transport, agriculture, carbon removal, finance, trade, the built environment and geopolitics – all the difficult stuff.

My own COP26, however, was not entirely smooth. First of all, my train to Glasgow was cancelled due to a tree falling on the line. Stuck at Euston Station I ran into my friend Chris Kaminker, Head of Sustainable Investment Research at Lombard Odier, and we decided to abandon the train and take my car. I tweeted that I had spare places, which earned me much kudos online, and soon five of us were settling in for the 7-hour drive, arriving in time for the first of many wonderful dinners at Blair. We literally got there just as the waiting team were serving a haggis starter.

It was my second week at COP that things really went off-piste. My wife Alice and our eldest daughter came up for the middle weekend to visit CASC and spend time in the Green Zone. Alfie was getting some great interviews for her school vlog, when Alice unexpectedly tested positive for Covid. We quickly packed the car and, windows open and heating full blast, headed South. Despite multiple negative Covid tests over the subsequent days, I was deemed too much of risk to return to CASC. Banished from my own castle – like King Lear – I spent most of the last week of COP26 working from home.

|

| What did you do during COP26, Daddy? Well, mainly I took Covid tests. |

Nevertheless, the main point is that CASC was a huge success. There are too many people to thank, but it would not have happened without National Grid’s Duncan Burt and Sandy Bhadal (the self-appointed birth mother of my brain child), Rachel Fletcher and Greg Jackson of Octopus Energy, Randy Bell, David Goldwyn and Andrea Clabough of Atlantic Council, Bryony Worthington, and my long-standing Liebreich Associates colleagues Jo Jagger and Michal Grabka. And of course Charles Hendry – the perfect, welcoming host throughout – his wife Sallie and her team at the Blair Estate, the events team from Agiito, the security and catering folks, and countless others.

My heart tells me I should revive CASC for COP27 in Sharm El-Sheikh (Scottish castle hospitality, but with snorkelling, anyone?) but my head tells me I shouldn’t. We’ll have to see which one wins.

Trade

My work as Advisor to the Board of Trade has been gathering steam. July saw the first in-person meeting of Board in Glasgow and the launch of our major report on Green Trade.

My Q2 piece for BloombergNEF was also on trade: Climate Action: It’s the Trade Stupid. In it I made a number of points:

- That Carbon Border Adjustment Mechanisms (CBAMs) are a bug fix not a killer app.

- That global trade, at nearly $20 trillion per year, holds the key to helping developing countries become wealthy enough to be full partners in climate action rather than aid recipients.

- That free trade in environmental goods and services would dramatically accelerate investment in clean energy and transport.

- That there is work to be done with our trading partners, the WTO and other multilateral institutions to ensure that trade drives a race to the top on climate and the environment, rather than a race to the bottom.

- And finally, if we have to have a CBAM, it must be multilateral, limited to dealing with carbon leakage, non-protectionist, rules-based, WTO-compliant, market-compatible, non-distortive, simple, and supportive of climate action by developing countries. Simples!

|

| Secretary of State Liz Truss briefing MPs on the work of the Board of Trade,15 September 21. Within hours of this photo, she had been promoted to Foreign Secretary and the Board of Trade had a new President, Anne-Marie Trevelyan MP. |

The Board of Trade’s third report, due to be launched at the end of this week in Belfast (I am editing this note on the plane), will be on Digital Trade.

We had just got started on drafting it when our President, Secretary of State Liz Truss was suddenly promoted to Foreign Secretary. Her successor, Rt Hon Anne-Marie Trevelyan MP, was a guest on the first day of CASC during COP26, and I am very much looking forward to working with her.

Hydrogen

The global debate on the role of hydrogen in a net-zero future has reached fever pitch, and I appear to be at the heart of it.

The story so far: in October 2020 I wrote a major two-parter for BloombergNEF, Separating Hype from Hydrogen. Part I covered the supply side – which is where most national hydrogen plans focus including the €460 billion EU Hydrogen Strategy. Part II, on the demand side, was where it got controversial because I explained why I am sceptical about some (though by no means all) of the use cases being promoted for the miracle molecule.

The Ladder

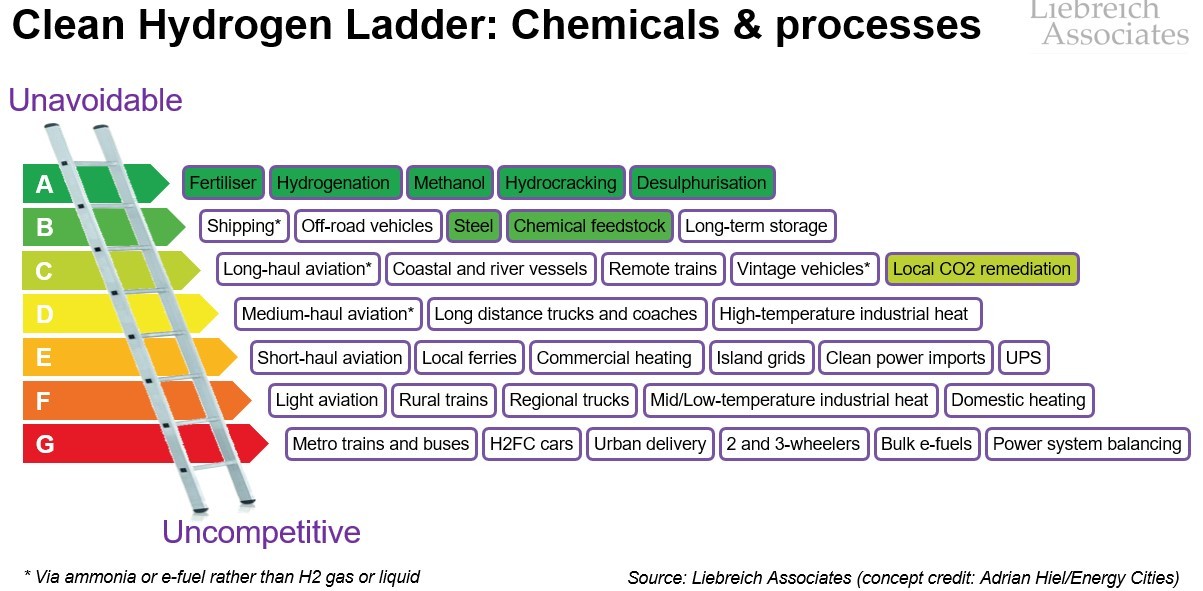

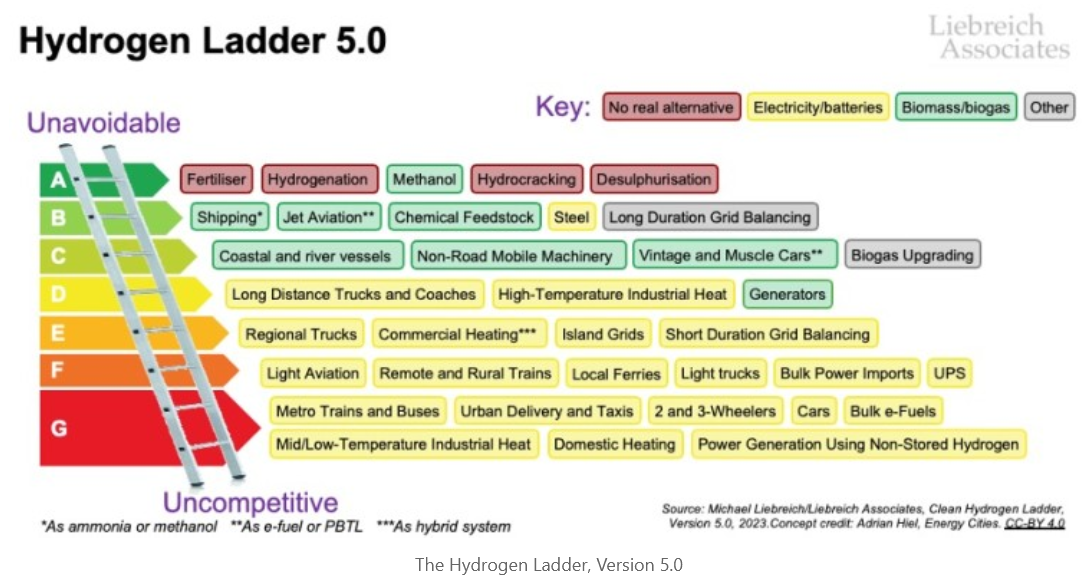

Proposed use cases for hydrogen range from sectors where grey hydrogen (made using fossil fuels) currently drives 2% of global emissions and must be replaced with clean hydrogen, to sectors where hydrogen has no chance of ever being competitive. To illustrate this and inform the debate, I have since created the Hydrogen Ladder, which got so much attention (and benefited from so much crowd-sourced wisdom) that I ended up releasing it under a Creative Commons license.

The Hydrogen Ladder is now on Version 4.1a, and no doubt further versions will be released as data emerges. It has been reproduced in the Economist, borrowed by various big consultancies, and spawned a cottage industry of commentaries, linked-in posts and podcasts. Which is all very gratifying, because it represents to the best of my ability four decades of learning and thought about physics, engineering, microeconomics, human behaviour, finance and geopolitics. If anyone doesn’t like it, they are free to publish their own version (annotated per the license terms, obvs).

|

| The Hydrogen Ladder. Feel free to download and use this under a Creative Commons license. |

BloombergNEF have kindly allowed me to publish audio versions of my blogs, I adapted my original hydrogen two-parter for my podcast, Cleaning Up. Part I, on the supply side and Part II, on the demand side, which I updated to integrate the Hydrogen Ladder, have been among the most popular episodes.

Blue vs green hydrogen

A second lively debate in hydrogen-circles revolves around whether “blue hydrogen” (made from fossil fuels but with carbon capture and storage) can be considered clean, and whether it should be eligible for support (the UK and US position) or not (the EU’s position).

In August I was worried that I had made my views a little too clear, saying: Capturing only 90% of CO2 emissions during production [and allowing high levels of methane leaks] ‘ain’t good enough’. Then things got a bit strange as I got into a scrap with Mark Jacobson – a Stanford professor famous for launching and losing a lawsuit against his academic critics – for critiquing a paper he wrote with Cornell’s Robert Howarth, which used a set of cherry-picked assumptions to show blue hydrogen in an exaggeratedly bad light.

For those who don’t want to get bogged down in the blow-by-blow, the bottom line is that if we allow blue hydrogen, we must produce it with near-zero methane emissions and near-100% capture of CO2 – which is well within the realms of science and engineering. Whether we do so or not is a political and economic question, not one of physics or engineering, and to portray it as such is simply disingenuous. My view is that climate change is too urgent for us to consign technologies to the dustbin because they or their owners fail some kind of purity test.

I wrote a short piece on the controversy here, and then another piece explaining the volume of hydrogen we might need for decarbonisation, how it cannot possibly be delivered in time by green hydrogen alone, and why I have therefore made peace with blue hydrogen – conditional on those very high required CO2 capture rates and very low fugitive methane emissions.

Ecopragma Capital

The last few months I have been working hard in the background on building my new enterprise, along with Henry Lawson and new partner Katherine Ireland. We have screened nearly 300 investment opportunities, identified over a dozen that look highly promising, and begun conversations with potential providers of funding.

If you are interested in being part of the EcoPragma Capital journey, there are three things we are always interested in:

- Investable opportunities – in particular those in growth equity: companies that have already achieved product-market fit and revenue momentum, but which need capital and could benefit from help from either my network or in navigating the digitisation wave;

- Investors – in particular family offices and institutional investors looking to put substantial funds to work in the technologies and solutions associated with net zero;

- People – in particular, professional investors with 5 to 15 years’ experience in venture capital or private equity, or growth equity bankers.

Cleaning Up

Cleaning Up continues to go great guns. We have now aired 65 episodes across the first four seasons, and our audience has grown to around 10,000 per month. At one point we reached number 2 in the UK News Comment category on Apple Podcasts.

Guests on Season 3 of Cleaning Up have included Tony Blair, Lord Browne, Lord Stern, Catherine McKenna, Sharan Burrow, Johan Rockström and others |

Season three

- As previewed in my last newsletter, Season 3 kicked off with a masterclass in geopolitics from Tony Blair.

- Next we tried a new format, a debate between two very dear friends of mine. Gareth Wyn Jones’s family have been upland sheep farmers in North Wales for 350 years; Ben Goldsmith went into the show thinking that land like Gareth’s should be rewilded.

- Naoko Ishii, former head of the Global Environment Facility and Sharan Burrow, General Secretary of the International Trade Union Confederation gave their view from the top of major organisations working at the coal face (literally) of climate action.

- Thomas Nowak, Secretary General of EHPA, educated us on heat pumps, Gina Domanig, the visionary founder of Emerald Technology Ventures did the same on open innovation.

- Angelina Galiteva, Chair of the CAISO Board of Governors explained California’s sometimes bumpy but inexorable road to clean electricity and brilliant Saudi energy commentator Yousef Alshammari talked about the Kingdom’s climate conundrum and plans.

- One of my most thought-provoking episodes yet was a chat with Johan Rockström, inventor of the Planetary Boundaries framework. If you want to understand the likelihood of catastrophic climate impacts (high, especially if we exceed 2C) and the time catastrophic impacts will take to hit (centuries rather than decades), then you do not want to miss this episode.

- The Rockström episode was complimented by conversations with the UK High Level Champion for Climate Action Nigel Topping and one of the world’s most influential climate economists, Lord Nicholas Stern – eponymous author of the 2007 Stern Review.

- Also appearing in Season 3 was Lord Browne, former CEO of BP, now launching a new fund called Beyond Net Zero. We had a wide-ranging chat about trends in energy, leadership and diversity – and why the UN is vocal on gender but shamefully silent on LGBTQ+ rights.

- Finally, BloombergNEF has agreed that I can make audio versions of the blogs I still write each quarter for BloombergNEF. I have made four Audioblogs so far, adapted from my pieces Climate and Finance, Lessons from a Time Machine, Climate Action – It’s The Trade, Stupid and my “Separating Hype from Hydrogen two-parter from last year: Part I on the supply side and Part II on the demand side.

Season four

- Season four started with a fascinating conversation with my fellow member of the Board of Trade, Tony Abbott. While we may not quite see eye-to-eye on Australia’s climate record, we do agree on the role of trade in making people wealthy, and the role of wealth in enabling countries to address environmental challenges. And we both think the Board of Trade’s recent Green Trade Report hit the right notes.

- The next episode was with political opposite Eamon Ryan, leader of the Irish Green Party, Minister for the Environment, Climate and Communications, Minister for Transport. Eamon has thought more deeply than most about what it means to build sustainable communities and the role of entrepreneurship – and I’m privileged to call him a friend too.

- One thing Cleaning Up is doing is creating a unique archive of retrospective conversations with key players in the Paris Agreement negotiations. That theme continued this season with episodes with Laurence Tubiana (France’s Climate Change Ambassador and Special Representative to COP21) and Todd Stern (who was Special Envoy for Climate Change at the US Department of State).

- Elizabeth Wathuti, a young biodiversity and climate activist from Kenya, was one of the stand-out stars of COP26, delivering a pitch perfect call to action. In episode 55 I talked to her about one of our mutual heroes, Nobel Prize-winner Wangari Maathai and about her work to restore Kenya’s forests.

- As is now well understood, finance is the key to climate action. In episode 56 the Rt Hon William Russell talked to me about the initiatives he has been pushing through as Lord Mayor of London (not London Mayor, that’s the useless chap who spent the pandemic criticising other people instead of doing his job). And in Episode 59 Alain Ebobissé explained how he was looking to leverage the $1 billion Africa50 fund to drive investment in clean infrastructure in Africa.

- One of my favourite ever episodes (I know, I am not supposed to have favourites but seriously, listen to it) is episode 57 with Julie Klinger. Assistant Professor of Geography at the University of Delaware, Julie is one of the world’s leading authorities on rare earths, their supply chains and associated ESG challenges. And an exceptionally good communicator.

- Two other hugely impressive women leaders talked with me about the future of the energy system in episodes 61 and 62: Julia King, Baroness Brown of Cambridge is the chair of the UK’s Climate Change Committee and author of the seminal 2008 King Review on decarbonisation of transport; and Damilola Ogunbiyi has taken over as CEO and UN Special Representative for Sustainable Energy for All from Kandeh Yumkella (episode 16) and Rachel Kyte (episode 2).

- Episode 58 is a special episode with John Redfern, founder of Eavor Technologies, the world’s leading closed loop geothermal energy company. You can read a bit more about Eavor’s progress below, or listen to this conversation to see why I think the next generation of geothermal innovation could be a BFD.

- Regular listeners will know that I have something of an obsession with emissions scenarios – partly because I’m a geek, and partly because vast sums of investment, stranded assets in the billions, banking stress tests and even the psychological health of our children rest on them, yet they are rarely critically examined. In episode 63 I dive in with Glen Peters, a real expert on what we should, and should not expect. And yes, we do touch on RCP8.5.

- As described above, in episode 64 I wonk out on the outcomes from COP26 with Guy Turner, Founder and CEO of Trove Research – leading provider of information on corporate net zero commitments and the voluntary carbon markets – and former head of carbon and chief economist at New Energy Finance/BloombergNEF.

- And finally, I don’t have many mentors, but Dan Doctoroff is definitely one of them. As CEO of Bloomberg LP he oversaw the mutually successful acquisition and integration of New Energy Finance. In the most recent episode of Cleaning Up, we compare notes and then talk about his more recent venture – building Alphabet’s Sidewalk Labs into a powerhouse of urban innovation.

My thanks as always to Pietrojan Gilardini and the Gilardini Foundation for their support in making Seasons 3 and 4 of Cleaning Up possible. We are looking for sponsors to support the next few seasons of Cleaning Up; if you want to help create the conversations of record of the net zero transition, contact the team and we’ll send you some more information.

If you don’t already, please subscribe now on Youtube or your favourite podcast platform – or at least follow @MLCleaningUP on Twitter or sign up for alerts on the Cleaning Up website so you don’t miss an episode!

Speaking, events

Over the past few months, I have participated in some superb events on energy and net zero, including the following:

- In May, I spoke on a panel as part of the Dublin Energy Dialogues on the implications of a rapid shift to net zero.

- June saw me deliver the opening keynote at the Institute for Economics and Financial Analysis’s annual Energy Finance conference on Two Energy Economies, One World.

- I always love talking to Robert Llewellyn, host of the Fully Charged show. This July’s conversation about the net zero transition was no different. And yes, we do talk hydrogen.

- So this was a really fun podcast to record. In September I did two-part interview with Bill Nussey on his Freeing Energy podcast, telling lots of stories about the founding of New Energy Finance and talking about trends in clean energy. Bill has a book out in December, also called Freeing Energy – don’t miss it.

- In October I was delighted to address the Global Race to Zero Summit organised by the Smart Energy Council of Australia, and talked about some of the efforts we grownups are taking to address emissions. And yes, I do talk hydrogen.

- Staying in the Southern Hemisphere, I was also invited by the New Zealand Climate Change Commission to participate in its international speaker series on Climate Action in Aotearoa.

- If anyone is interested in the history of how I created New Energy Finance (and a few bits and pieces about my new projects, don’t miss this November conversation with Bret Kugelmass of the Energy Impact Centre.

- Just before COP26, I moderated this very topical panel discussion at the Arctic Securities / IEA conference in Stavanger, on “Can clean energy companies be profitable?

- Since COP26, I have been providing reflections on COP26 at various forums, including the Saudi Green Initiative Summit at Waddesdon Manor.

If you want to talk to me about speaking at an upcoming event, please do get in touch with my famous EA, Jo Jagger.

Angel portfolio news

It has been another busy six months for my angel portfolio, bless them:

- Chargepoint. Amazingly, over a year after the announcement of Chargepoint’s SPAC and 9 months after its completion, my investment is still largely locked up. Luckily, Pat Romano and his team have been beating their forecasts each quarter and raising guidance, and President Biden has signed his Infrastructure Bills into law, so I’m not complaining too much.

- Clean Growth Fund. I’m only an advisor, but it’s great to acknowledge momentum when you see it. Beverley and her team have made three new investments: thermal battery company Tepeo; process optimisation software provider Carbon Re; and biosurfactant company Holiferm. Over the summer Beverley secured another £20m investment and was highly commended in the 2021 Business Green Awards, Leader of the Year category.

- Cypher Coding. Elizabeth has done a great job leading Cypher, pivoting during Covid from in-person to virtual coding clubs and launching a subscription service. Elizabeth also raised another £422,000 at a nice valuation and has just won the Great British Entrepreneur 2021 prize for London’s best startup Pivot. If you are looking for an edtech startup to back, you need to talk to Elizabeth.

- Eavor Technologies. John Redfern and his team at Eavor are making great progress. In May, Dutch research powerhouse TNO validated Eavor’s thermodynamic modelling (gratifying, in the light of a social media campaign to discredit it by a vocal proponent of the competing approach which involves fracking). Eavor has also been getting some of the press coverage they deserve – examples here from Euractiv, Bloomberg BNN, Fortune Sustainability Inc, Globe and Mail, Wood Mackenzie. My own contribution to the Eavor-appreciation genre was this October piece I wrote for the New York Times, comparing its next-generation closed loop geothermal technology with the Eierlegende Wollmichsau, a mythical German farm animal that meets all human needs for food, drink and fibre simultaneously with no drawbacks.In September Jesse Jenkins, Princeton professor and all-round guru on energy systems, published a paper through his company DeSolve on the potential impact of Eavor’s technology on the cost of transitioning to net zero power. TLDR: it could save tens of billions of dollars, and that’s just in a single regional US power market. Shortly afterwards I was pleased to welcome Jesse Jenkins, to Eavor’s Advisory Board.

|

| Is Eavor’s closed loop geothermal technology the mythical “egg-laying-wool-milk-pig” of energy, able to meet multiple needs at once without compromise? |

- Modo Energy. This one just missed the deadline for my last newsletter: Modo raised another £1m to invest in their energy data and analytics services. I love what Quentin, Tim and the team are doing, it reminds me so strongly of the early days of New Energy Finance, only with machine learning.

- Xlinks. In September XLinks came out of semi-stealth mode, with a big public and press reveal. If it’s not on your radar screen it should be: 10.5GW of wind and solar generation and 20GWh of batteries, providing 3.6GW of dispatchable clean electricity to the UK via a 3,800km cable route. In addition, we have created the spin-off XLCC to create a new-based subsea HVDC cable manufacturer and commission our own cable-laying vessels. The ambition is stunning, and so is the execution. In September, former Tesco CEO Sir Dave Lewis joined XLinks as executive chairman.

- Zeelo. In August Zeelo closed on an additional £12m of funding on the back of 600% growth during the pandemic, and now looks unstoppable. It has now grown nearly 4x in each of the last two years, become one of the UK’s largest specialist bus services for schools and the logistics sectors and landed its first clients in the US. One to watch.

* * *

So there you have it. Another incredibly busy half-year. Stay healthy and safe, this pandemic is not over. And I’ll check back in with you early in 2022!

Hasta la victoria siempre!

Michael

Terms of use: photos and other media may be used exclusively for the purpose of publicising an upcoming or past event involving Michael Liebreich, or to illustrate an article written by him. Their use must be accompanied by a clear indication of copyright in the following form:

© Liebreich Associates/name of photographer. Photos or other media downloaded in this way remain the property of Liebreich Associates Ltd. Any infringement of these terms of use may result in legal action by Liebreich Associates Ltd or by the respective photographer or rights holder.