BNEF: In Energy and Transportation, Stick it to the Orthodoxy!

Written for Bloomberg New Energy Finance, click here to read the online article

By Michael Liebreich

Chairman of the Advisory Board, Bloomberg New Energy Finance

Those of you who attended this month’s Bloomberg New Energy Finance EMEA Summit in London will have witnessed “Breaking Clean”, the last of my State of the Industry keynotes. These seem to have become something of an institution: there have been 14 of them since 2008, spanning London, New York and Shanghai. Each time I did my best to catch the zeitgeist of our industry, highlighting the key trends and big news stories, and throwing in a few visual gags for good measure.

In case you are wondering, I don’t expect to disappear. I will continue to write opinion pieces a few times a year. But I thought I would take this opportunity to talk about a topic dear to my heart: forecasting. Why are most energy analysts so bad at it, what happens when you get it wrong, and why the Bloomberg New Energy Finance team has managed to do better than most.

First of all, forecasting anything related to energy is hard. Even back when there were no significant new technologies roiling the markets, there were huge uncertainties. Prices are set by the marginal supplier; combine that with the vagaries of geopolitics, and you have a naturally unstable brew. Until the advent of fracking, depletion was busy concentrating an increasing proportion of resources in the most volatile and least transparent countries in the world. Energy is a complex system, interacting with all the other complex systems in our economy – finance, politics, transportation, market cycles, consumer behavior – and frankly it is a fool’s errand to pretend one can gain more than directional insight into some of the major trends.

Not that this has stopped a whole industry of pundits from trying. You have only to watch half an hour of any business channel to see at least one so-called expert opining on future oil prices. I say so-called, not because they lack credentials, but because they generally lack the successful track record that is the only true test of expert punditry. If these TV stations would research what their talking heads had predicted in the past – before the oil price surges of 2007-2008 and 2011-2012, say, or before the crashes of late 2008 and 2014 – they would realize they might as well interview Bubbles the Chimp. Bubbles doesn’t spend his time tracking tankers, monitoring storage levels at Cushing or listening to OPEC press conferences, but his views on oil prices are rendered no less valid by his intuitive approach.

But what about the long-term forecasters – the International Energy Agency (IEA) and its U.S. counterpart, the Energy Information Administration (EIA)? What about the oil companies, with all their resources and their legions of economists? What about energy ministries, grid operators, treasury departments, academia? From the earliest days of my Summit presentations, I have raised a reliable laugh by comparing their past clean energy forecasts with historical out-turns. There is now a whole internet genre making such comparisons, bringing pleasure to millions. I feel bad about it – many of the authors of these forecasts are friends and clients – but if they don’t want to be mocked for their forecasts, they either need to improve them or stop publishing them.

Just to be clear, it’s not like our own NEF/BNEF forecasts have always been spot on. To take one example, even though we were more bullish than anyone on the potential for wind and solar to reduce costs, and even though we spotted the fact that feed-in tariffs had kept prices artificially high between 2004 and 2009, we were surprised by the extent to which they subsequently dropped.

And yes, I am familiar with the line that these are not forecasts but scenarios, intended only to show what happens under certain input assumptions. I reject it. First of all, as far as the world at large is concerned, if it looks like a forecast, swims like a forecast and quacks like a forecast, it is a forecast. It will be used to inform actual investment and policy decisions. And if that is not the intention, why publish it at all? Meanwhile, if your assumptions consistently produce bad results, make some new ones. Garbage out? Stop putting garbage in!

You can immediately see the problem if you take the first derivative of those IEA solar capacity forecasts: each time, the assumption is that installations have reached some steady state and will no longer grow. The 2016 IEA World Energy Outlook New Policies Scenario shows PV capacity additions flat at around 50GW per year out to 2040. In 2017, just one year later, the world’s PV industry will install around 90GW. And in the boardrooms of the world’s solar suppliers, from ingot to wafer to cell to module, do you think they are planning on staying the same size? Or are they planning to grow? Is there any real doubt that solar manufacturing – despite the nonsense currently going on in the Suniva case in the U.S. – is still in a growth phase?

In wind it’s even worse: the IEA’s latest New Policies scenario shows wind installations falling consistently from the current 60GW per year to 40GW per annum by 2040. Hello? Have they not seen that onshore wind is the cheapest form of bulk new electricity in more and more countries in the world? Are they not following the trends in offshore wind costs? What do they think will happen when new wind and solar become cheaper than running existing fossil fuel plants? When the record low price for either goes below 2 U.S. cents per kilowatt-hour. Because that will happen.

I really didn’t set out to dump on the IEA. They do a magnificent job marshalling information on the world’s energy system, analyzing trends and helping manage potential supply shocks. There are far worse outfits out there, ones that don’t have the same weight as the IEA and EIA. However, bad forecasts from authoritative agencies have consequences. They are self-reinforcing. When the IEA and EIA say – as they did for many years after I founded New Energy Finance – that modern renewable energy will produce less than one percent of the world’s electricity many decades into the future, that deters serious politicians, investors or business people from backing them. They also lead to bad decisions, which destroy wealth. Never mind the stranded assets of the future, just look at the stranded assets of the recent past.

As I pointed out in my keynote last week, since September 2011, many hundreds of billions of dollars of investors’ funds have been deleted by poor investment decisions by the U.S. coal, oil and gas industries, European power utilities and oil-producing nations. What’s so special about September 2011? Nothing. It just happens to be the date Solyndra went bankrupt, losing around $500 million of U.S. Department of Energy loans – a paltry amount in comparison with lost tax revenues from troubled conventional energy companies.

Of course not all of the recent losses by conventional energy players were caused by underestimating the growth of renewable energy, though the write-downs and breakups of the European utilities certainly were. There have been three energy and transport Black Swans in the past 15 years. I joked in my Summit remarks that auto manufacturers call them the three “F”’s: Fracking, Fukushima and Elon Musk. Black Swans like these are so far outside the normal run of events that no forecaster, however good, can foresee them. However, you can still prepare for them. A false sense of certainty in a central scenario leads to the undervaluing of options. KKR & Co, TPG Capital and Goldman Sachs Capital Partners were so certain the U.S. would be increasingly short of natural gas, they bet $45 billion on coal-based generator TXU Corp. The outcome was not good.

You have to assume that the executives who lost all this money, and certainly their investors, would rather they had not made such catastrophic calls. They had access to all the best information, and still made terrible decisions, clearly based on a world view seriously out of kilter with reality. Why?

In politics there is a concept called the Overton Window, which describes the range of ideas the general public considers to be worthy of civilized discourse. Some apparently sensible ideas – raising fuel taxes in the U.S., say, or allowing a broad range of non-nationalized health providers in the U.K. – are simply outside the Overton Window: too controversial and dangerous for any serious politician to touch.

The energy and transport sectors suffer from a similar phenomenon, we can call it the Orthodoxy Window. This is the range of potential scenarios for the future that are considered reasonable by sensible, mainstream people. There may have been a Cambrian Explosion of new technologies and business models in the last two decades; there may be an increasing body of data – much of it furnished by Bloomberg New Energy Finance – on the economics of new clean energy technologies; there may be massive businesses being built around these technologies and business models. Yet for most traditional energy industry participants, the idea of truly transformational change remains outside the Orthodoxy Window.

The Orthodoxy Window is maintained by a whole ecosystem of supposed thought-leaders, all trying their hardest to avoid having to think uncomfortable thoughts. Industry bodies trumpeting the world’s vital interest in protecting fossil-fuel- and diesel-engine-producing incumbents; respected analysts who are nothing but oil industry shills; right-wing commentators who talk like libertarians but walk like corporatists; bloggers and Twitterati, whose certainty that the energy and transport sectors can never change is inversely proportional to their knowledge. Pity the general public, correctly wary of wrenching change, threatened by this mob each time they think of peeking outside the Orthodoxy Window.

Over time, in politics, Overton Windows move. Ideas that were once considered fanciful enter the national discussion, and some eventually become policy. Sometimes that move is entirely negative, as is the case with much of what is currently happening in the U.S.; sometimes it is positive, such as when discussions of road pricing, gay marriage, or smoking pot stop being off-limits, and move towards becoming socially accepted. As we speak, the concept of a carbon price appears to be making its way into the Overton Window of the U.S. Republican Party.

So too with the Orthodoxy Window in energy and transportation. Scenarios that would once have been considered outrageous become, with the passage of time, mainstream. The IEA’s New Policies Scenario shows 16% of the world’s power in 2040 produced by wind and solar – still too low by a factor of at least two, but better than the nugatory proportion it was predicting only recently. Last year OPEC increased its estimate of the number of electric vehicles in the world fleet by 2040 from under 50 million to over 250 million – still too low, but acknowledgement that the future does not look like the past. Ben van Beurden, Shell’s CEO, has stated publicly that his next car will be electric.

I am very proud that NEF, later BNEF, appears to have played a meaningful role in moving the Orthodoxy Window to where it is today. One reason we managed to call some of the big trends right is that we started out looking at disruptive technologies, and approached the rest of the system from there; another has been our emphasis on exhaustively collecting primary data on costs and capital flows; and finally, we have always looked at things through an industrial microeconomics lens as much as through a resource economics lens, for instance investing heavily in understanding experience curves, material science and information technology, which has been key to our understanding of the transforming landscape.

There is now a new orthodoxy in energy and climate, which I summed up in my Summit keynote: in the world of 2040, one third of power will come from wind and solar, one third of vehicles will be electric, and the economy will be one third more energy-efficient than today.

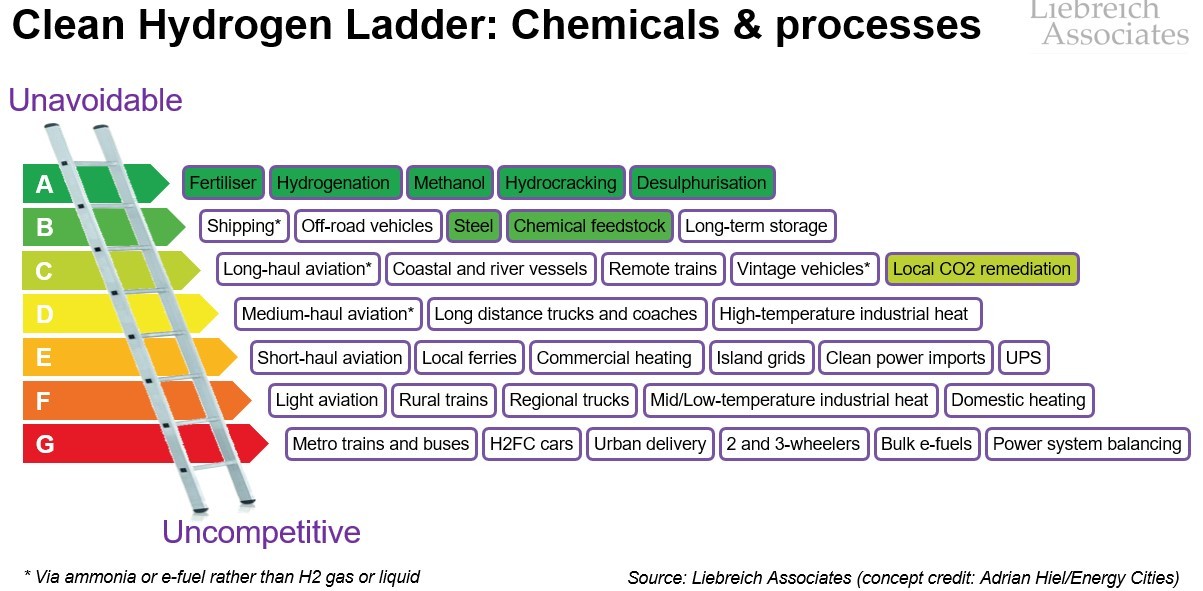

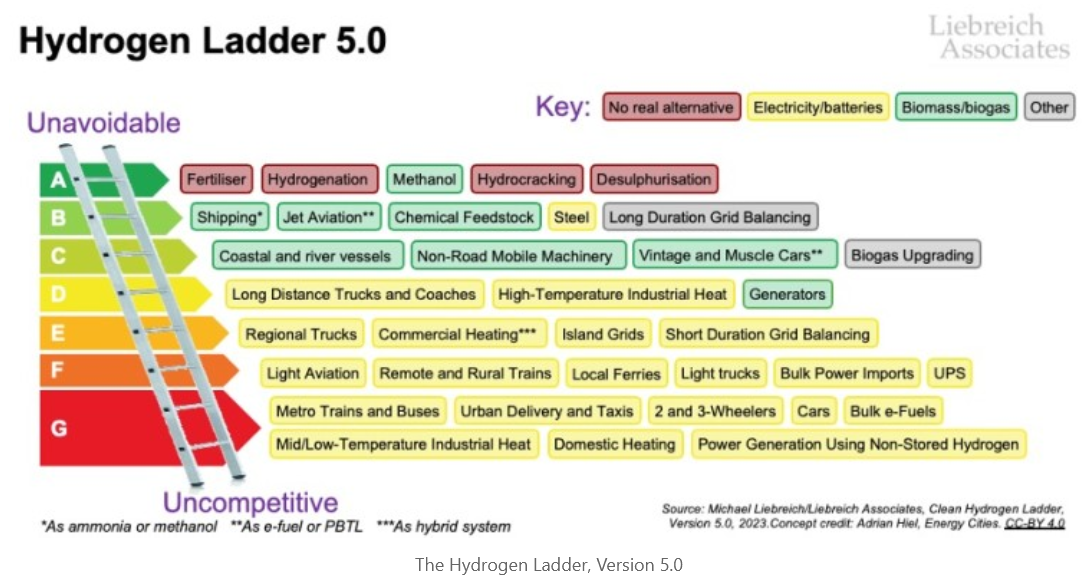

However, there is much more to do. In too many areas the Orthodoxy Window is still tightly shut. For instance, the majority of people I meet still believe the following: the cost of managing intermittency is prohibitive; demand rebounds to eat all the benefits of energy efficiency; industrial processes are inevitably lumbering, inflexible and fossil-fuel powered; long-distance freight can only be carried by dense liquids; those lacking modern energy services would be better off waiting for a centralized grid, rather than using distributed solutions today; advanced biofuels will never work; the answer to every long-term question is hydrogen; self-driving cars will eat the world; England will never win another football World Cup.

Most likely none of those statements will prove true in the long term, except maybe the last one. Though even when it comes to soccer, we may be surprised. And how we need to be surprised! For the past three years, greenhouse gas emissions have been flat, despite a growing world economy. At most, the current orthodoxy – despite its renewable energy, electric vehicles and energy efficiency – will result in flat or gently declining emissions. As the science behind the Paris Agreement has clearly stated, to stay within 2 degrees Celsius of warming from pre-industrial levels, emissions need to reach net zero sometime this century. That is within the expected lifetime of our children.

The rallying cry of the French decadent poets of the late nineteenth century was: “Il faut épater la bourgeoisie” – loosely translated as “You have to stick it to the bourgeoisie!”. As I drop the mike, my keynote-delivering job at Bloomberg New Energy Finance Summits done, let me suggest a slogan for all of us to live by, whether we want to build a new energy and transportation future, or just to avoid losing billions of dollars: “Il faut épater l’orthodoxie!” We have to stick it to the orthodoxy!

I would also like to take this opportunity to thank those of you who have attended any of the last 14 New Energy Finance / Bloomberg New Energy Finance Summits, or who have ever watched my keynote on the internet. You have been the most wonderful, spirited, challenging and, above all, supportive audience.

Michael Liebreich’s keynote video and slides from the 2017 Future of Energy EMEA Summit are available here.

Terms of use: photos and other media may be used exclusively for the purpose of publicising an upcoming or past event involving Michael Liebreich, or to illustrate an article written by him. Their use must be accompanied by a clear indication of copyright in the following form:

© Liebreich Associates/name of photographer. Photos or other media downloaded in this way remain the property of Liebreich Associates Ltd. Any infringement of these terms of use may result in legal action by Liebreich Associates Ltd or by the respective photographer or rights holder.