January 2020 Newsletter: A Decade Closes, a Decade Begins

Here we are in the first weeks of a new decade, and I wanted to give you an update. I would have much preferred to catch up in person, but time whizzes past so fast, that might not have happened for far too long!

Incredibly, last month marked 10 years since the sale of New Energy Finance to Bloomberg. I still write for BloombergNEF four times a year, but I have no executive role there. Other than that, I do quite a bit of paid public speaking; hold advisory roles with Equinor, Sustainable Development Capital Limited, Ignite Solar and a small number of leading charitable and multilateral organisations; do a bit of consulting; and manage a modest portfolio of angel investments. I’m still based in London, though I spend school holidays in Switzerland.

I remain as convinced as ever that we are witnessing the start of a multi-decadal transition to a low-carbon economy. Progress is not smooth, nor by any means as fast as it needs to be from a climate perspective, but it is nonetheless happening. If you have the time to read on, I have summarised below some of the energy, transportation and finance discussions in which I have been involved, and shared a few thoughts over what the next decade might hold.

Menu:

1. The Three Third World

2. Beyond Three Thirds

3. Transformation of Transportation

4. Green Finance

5. Politics and Policy

6. Project Bo – Reliable Power for a Neonatal Unit in Sierra Leone

7. Moving Mountains – Sustainability of Mountain Communities

8. Angel Investing

9. Other Topics

10. The Decade Ahead

Appendix: 2019 in Figures

If you think there is any way I could support your activities in 2020, either via Liebreich Associates or directly, please do not hesitate to get in contact!

In any case, I wish you, your family and your team a happy new year, and I hope our paths cross soon.

Warm regards,

Michael

Michael Liebreich

Chairman & CEO

Liebreich Associates

1. The Three Third World

The bulk of my work continues to be about identifying trends in energy and transport, and communicating them to high-level decisions makers. I am happy that I still seem to be in demand as an advisor and speaker.

Over the past couple of years I have structured many of my presentations around a framework I call the “Three-Third World” – the idea that by 2040 one third of global electricity will be generated from wind and solar (over 50% will be zero-carbon, once you add hydro and nuclear power); one third of the vehicle fleet will be electric (over 50% of new sales will have to be electric to get there); and the global economy will be one third more energy-productive.

If you have never have seen me explain the Three-Third World, you can watch my June 2019 presentation at Auckland Business School in New Zealand. I also used it in my opening keynote at the inaugural Energy Disruptors conference in Alberta, Canada in 2018 (which starts with my provocative piece of New Year wordplay, Time to Face Reality, still the most popular thing I have ever written), and which I updated at the second Calgary Energy Disruptors conference in September 2019.

I am not at liberty to share videos of the many corporate and investor events at which I speak, but for a taste of some of the other topics covered in keynotes during the past year, here are some clips of me explaining why the penetration of cheap renewables into the power supply is now unstoppable at the Naturgy/IESE Energy Prospectives, Madrid in March; looking at the prospects for very deep decarbonisation of the European electricity system at the 2019 EURELECTRIC Power Summit, Florence in May, or warning of a tougher times on the horizon for the Dutch solar power sector at SolarPlaza Utrecht in June.

For an accessible overview of my take on climate and energy, listen to this episode of the Exponential View with early NEF investor, Azeem Azhar: Renewable energy, climate change, and technology. If you don’t subscribe to his podcast, you really should, it’s fantastic. Another podcast I did during the year was on resilience, as part of DNV.GL’s Face the Facts series.

One of my highlights of 2019 was being invited by Fatih Birol, head of the International Energy Agency, to join the Global Commission for Urgent Action on Energy Efficiency. It’s a stellar group, and our goal is to increase the rate of increase in energy productivity in the global economy from 1.5% to 3%.

But that was not my only foray into the world of energy efficiency in 2019. In March the Financial Times carried a big piece entitled ‘How to do a green home renovation’, complete with pictures of me staring wistfully at a light fitting. Frankly, given that it highlighted the painful process of finding architects, builders, plumbers and heating engineers capable of doing a deep green retrofit, it could have been called ‘How Not To Do A Green Home Renovation’! But we did get a Grade A for our Energy Efficiency Rating, one of just 0.1% of existing UK homes and probably the only mid-Victorian townhouse in Notting Hill Gate to do so.

If you want me to talk to your team, investors, or other stakeholders about the Three Third World, let me know!

2. Beyond Three Thirds

The Three-Third World may be far beyond what any of us thought would be achievable a decade ago – enough to flatten emissions, of which more later – but it will not get us on track for a 2C future, as demanded by the Paris Agreement, much less the 1.5C on which much climate action is now focused.

In April 2018 I wrote a piece entitled Beyond Three Thirds: the Road to Deep Decarbonisation, which described the challenge posed by hard-to-decarbonise sectors like heating, shipping, aviation, long-distance transport, and heavy industry. That piece has aged pretty well – now that the world has started to focus on net-zero emissions (77 countries have made some sort of commitment by the end of 2019, led by the UK but now including the EU), work on these hard-to-decarbonise sectors has begun to accelerate dramatically.

My June 2019 week in New Zealand as the guest of fuel distribution market leader Z Energy was fantastically intense, with 12 presentations, 10 roundtables with ministers and industry associations, four dinners, my first ever bungy jump and eight media appearances. In one newspaper interview I was asked what I had found unexpected about New Zealand on my first visit. My straight answer resulted in this headline the next day: Fonterra burning coal to dry milk ‘insane’ and must stop, says British energy expert. (Fonterra is the cooperative producing most of New Zealand’s milk powder). A month later, came these two articles: Fonterra pledges to stop building new coal boilers immediately and Converting three Fonterra factories to gas could save 100,000 tonnes of carbon emissions. I can’t claim that my comments led directly to Fonterra’s decisions, but it shows how quickly major emitters are starting to move.

In July last year I finally grasped the nettle and wrote up my views on nuclear power, in a piece for BloombergNEF entitled We need to talk about Nuclear. I argued that we should move beyond tribal arguments between uncritical supporters and implacable opponents of nuclear power, distinguish between the economics of keeping open existing plants and building new ones, and not rule out the possibility that the next generation of reactors – either fission or fusion – could be an important weapon the global fight against climate change.

I must have got the balance about right: some denounced me for not rejecting wind and solar power as inherently useless, while others were furious that I refused to back a blanket ban on nuclear power. When a former Swiss MP, university lecturer and chair of the country’s leading sustainable investment platform weighed in with a false claim that Chernobyl left “more than a million dead”, I called him out – and our spat made a number of Swiss newspapers, including the influential Basler Zeitung.

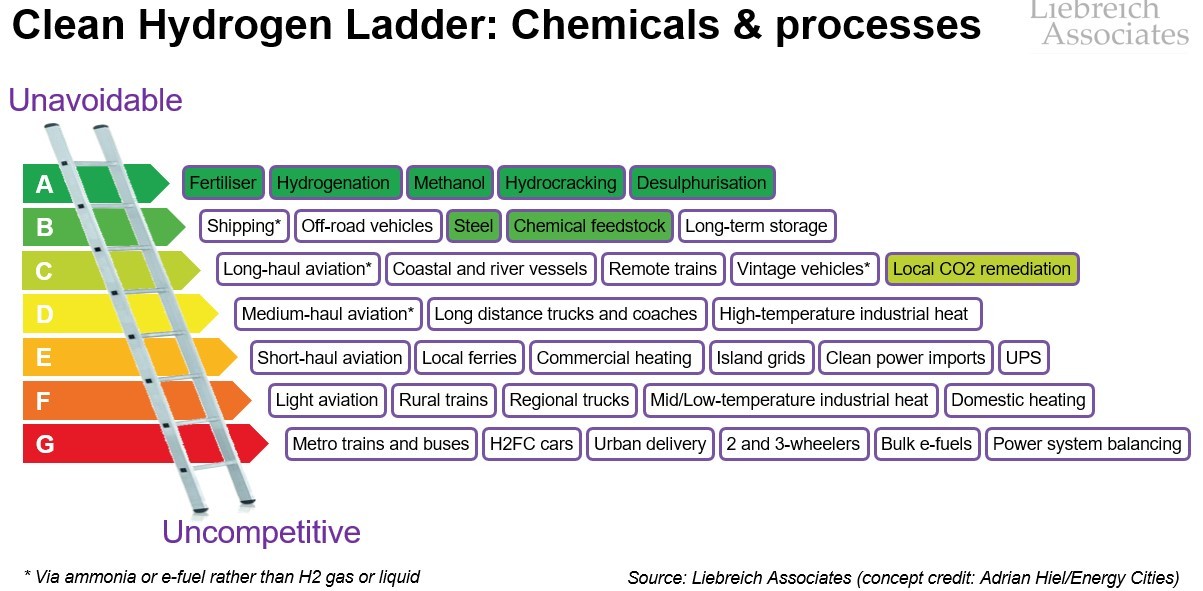

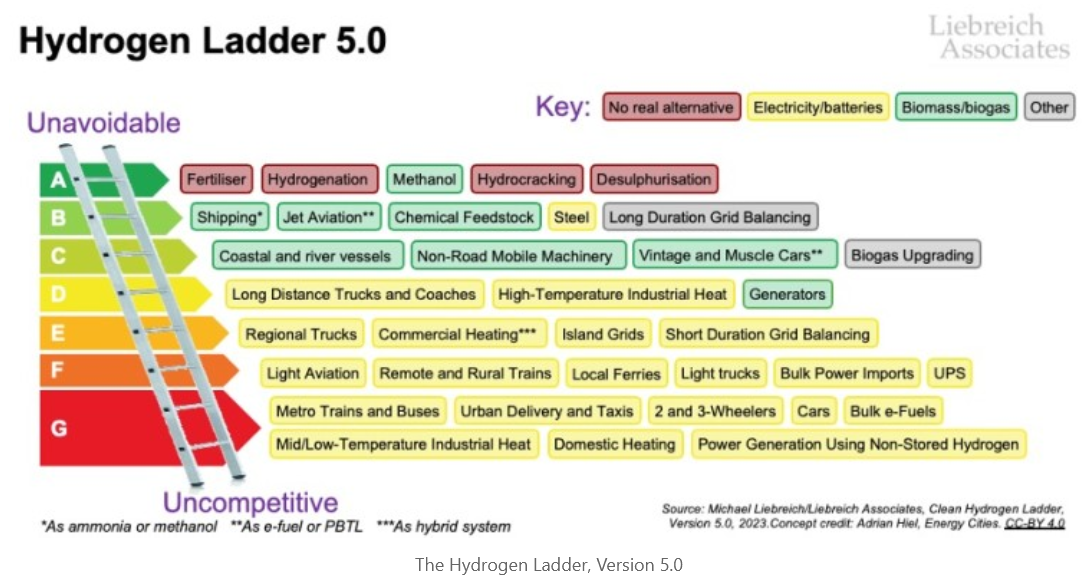

My next piece for BloombergNEF will be about hydrogen and ammonia. I am not a big fan of hydrogen cars (see the next section), but hydrogen and ammonia will certainly play a big part elsewhere.

If you want me to help you think through how to decarbonise difficult sectors, please get in touch!

Back to the menu

3. Transformation of Transportation

The broader implications of the shift to EVs is a topic I have been writing about for years, for instance, this 2017 piece Ten ways the electric car revolution will transform the global economy.

The press is fascinated by the impending disruption of the auto industry, as evidenced by a September 2019 article, spurred by my keynote at the Energy Disruptors conference in Alberta, Canada: Shift to electric vehicles in Alberta is ‘inevitable’. How fast might the shift happen? There is much wonderful academic work on logistics, or penetration curves, but I have a simple analogy – that waiting for them to take off is a bit like waiting for a sneeze – which caught people’s eye in this Guardian article: Rise of Renewables May See Off Oil Firms Decades Earlier Than They Think.

At the end of 2019, I recused myself from the Observer Group of the Global Hydrogen Council because, instead of focusing on sectors in which hydrogen could perhaps win (industry, aviation, shipping, grid backup, long-distance transportation and heating), it continues to promote hydrogen cars. By now, it is simply not tenable to argue that hydrogen cars have only a short-term cost disadvantage versus battery electric vehicles: they are far more complex; they require a whole new fuelling infrastructure; they are much less efficient; and they offer a worse driving experience – all of which I discuss in this presentation.

One debate that would not die in 2019, but I hope does so in 2020, is whether EVs are in fact better for the climate than internal combustion vehicles. The short answer is that they are significantly better, and the difference will grow over time, although far from environmentally perfect. If you want chapter and verse on this discussion, my great friend Auke Hoekstra has written a great debunking of absurd claims to the contrary, and a peer-reviewed paper on The Underestimated Potential of Battery Electric Vehicles to Reduce Emissions.

The transport debate is not only about cars and light trucks. Late in 2018 I wrote about how electrification will also sweep through other forms of transportation in Planes, Trains and Automobiles – the Electric Remake. At the time, there was very little coverage of electrification of aviation, or even of ferries and other coastal and inland vessels. What a difference 18 months makes – I am now asked to talk about this quite a bit, and the market is moving fast.

Another important question on which I have focused is the future of urban and peri-urban transport, the topic of a breakfast discussion at the launch of Auto Futures Live which I chaired in June 2019. The past few years have seen an inordinate amount of funding flowing into micromobility: shared and electric bikes, scooters and the like. What is missing is a focus on macromobility, which I define as moving large numbers of people over medium distances in shared vehicles, something I explain in the introduction to this booklet on the future of commuting, published by Zeelo in October 2019.

Finally, an update on TfL, where I left the board in September 2018. I was recruited by Boris – now Prime Minister – Johnson, and kept on by Sadiq Khan, but only for half of a normal term. I am very proud of the impact I was able to have during my time on the board – particularly as a member of the Finance Committee and chair of the Safety, Sustainability and HR Panel. I had hoped to stay on, but I was increasingly at odds with management over their defensive response after the Sandilands tram crash (in which seven people died) and their failure to inform the Finance Committee about delays in the Crossrail project. Sadiq took their side over that of transparency, which was a disappointment. It was a huge privilege for me to serve the city I love for six years, and I hope it will not be the last time I get such an opportunity.

If you want me to come in and talk about the Transformation of Transportation, please get in touch!

Back to the menu

4. Green Finance

It seems incredible that it was as recently as 2013 that I wrote a leader for the World Economic Forum in which I accused the world’s financial system of being “institutionally fossilist”, highlighting all the ways in which it discriminated against investing in clean energy, clean transportation and other climate solutions.

Fast forward to 2020, and it’s a different world. Around $120 trillion of financial assets – almost exactly half of the global total – are managed by organisations that have signed up to the Principles of Responsible Investing (PRI), the Task Force on Climate-Related Financial Disclosures (TCFD), or both. Almost every financial centre in the world now has some form of green finance initiative; one of the first trips I made in 2019 was to Abu Dhabi, where I was a keynote speaker and chaired the launch of the Abu Dhabi Sustainable Finance Forum.

For some years now, I have been a member of the advisory board of the OECD’s Centre on Green Finance and Investment. In November 2018, I gave a keynote at the 5th OECD Green Finance and Investment Forum. If you have 20 minutes and you want to know why it is important for investors to act on climate change today, rather than some time in the distant future, please watch it and let me know what you think!

As I write this, Larry Fink has just rocked the financial world by announcing that Blackrock, with its $7 trillion of assets under management, will now make climate change central to its investment decisions. Virtually every asset owner and asset manager I speak to wants to make their portfolio compatible with climate science and the Paris Agreement. This is not a trivial challenge – the questions are tough, the data is poor and almost all of the tools being promoted are flawed.

If you think I might be able to help you navigate the world of Green Finance, let me know!

Back to the menu

5. Politics and Policy

As you may know, in 2015 I considered standing for Mayor of London. In the end I didn’t do it: a combination of having too many interesting projects, a young family, financial commitments, and a belief that Zac Goldsmith would be the better candidate. I don’t rule out standing in the future, but I have no plans for 2020.

At the end of 2018, I pointed out in a piece for BloombergNEF, Two business cycles to prepare for a low-carbon world, that the pendulum of public opinion might have started shifting back towards climate action. And so it had; during 2019, climate change spilled onto the streets, in the form of Greta Thunberg’s Fridays for Future, the Sunrise Movement in the US, and Extinction Rebellion in the UK. In this February 2019 piece for BloombergNEF, Green New Deal – Trumpism with climate characteristics?, I dissected the $1 trillion per year cost of the Green New Deal proposed by Alexandria Ocasio-Cortez and the left of the Democratic Party.

It was not just the young, activists, green parties and the hard left that were demanding action by the end of 2019. As someone who has been working at bringing the centre right on board with climate action, this development was long-overdue, but gratifying. In 2014 in Why clean energy needs less regulation, not more, I argued that conservatives need to accept the fact that climate change is real and produce their own solutions (a version of the piece also appeared in the launch booklet of the Conservative Environment Network (pdf), which marked the beginning of Michael Gove’s public role as an advocate for the environment). In summer 2018, I wrote a long Twitter thread about what a conservative response to climate change might look like, which a surprising number of people encouraged me to turn into a book (as if I have time!).

Late in 2018 I wrote a deliberately provocative piece for the Initiative for Free Trade entitled The secret of eternal growth, taking aim at the “degrowth” movement, who believe that capitalism is fundamentally incompatible with a healthy environment. It generated a heated debate on Twitter, leading to an invitation in February 2019 to appear on The Burning Question on BBC Radio 4, debating with one of the leading proponents of thermodynamic limits to economic growth and author of “Prosperity without Growth”, Professor Tim Jackson. It also led to an in-person debate in March at the Overseas Development Institute entitled Can green growth solve climate change? with popular development economist Kate Raworth. It is worth noting that Degrowth vs Sustainable Development is just the latest round in the long-running dispute between those backing revolution, and those who would prefer reform of the existing system. Herbert Marcuse and Karl Popper were the standard-bearers for the two sides in the 1960s; not surprisingly, I prefer Popper’s arguments to those of his Marxist opponent.

Talking of Marxists, 2019 ended with a rancorous election in the UK. The voters have already delivered their verdict, but should you wish to remind yourself of just how awful a candidate Jeremy Corbyn was, you can always read Of Policies and Pogroms, written just before the election. In it, I take a look at the Bolivarian energy and transport policies in the Labour Party Manifesto and give my reaction, as an Olympian, to Corbyn’s wreath-laying for of the masterminds of the 1972 Munich massacre. Alternatively, listen to this pre-election of episode of BBC Radio 4’s flagship environmental programme, Costing the Earth, in which I explain why 2050 is about right as a target date for net zero emissions – in terms of science, economics and geopolitics.

There will be a lot more politics in 2020. Six things worth watching: whether the Johnson government puts flesh on the 2050 net zero commitment; the success or failure of COP26 in Glasgow; whether the EU’s Green Deal achieves escape velocity or goes the way of the Lisbon Agenda; whether China’s talk about greening its Belt and Road initiative is translated into action; and how Scott Morrison emerges from Bushfiregate; and of course the US Presidential election, which will decide whether the country gets four more years of a President who is pulling his country out of the Paris Agreement, a President who tries (and probably fails) to enact a radical Green New Deal, or a President capable of bringing the country together around a coherent climate, energy and transportation plan.

If you want my thoughts on a particular policy issue, get in touch!

Back to the menu

6. Project Bo – Reliable Power for a Neonatal Unit in Sierra Leone

In December 2017, as I was on my way to a fancy industry dinner, this tweet popped up in my timeline:

It was sent by Dr Niall Conroy, an Irish doctor, who had set up a neonatal unit at the government hospital in Bo, Sierra Leone. In 2017, around 25% of the 80 or so babies admitted each month were dying, often for lack of oxygen and warmth during the frequent power cuts. My wife and I, along with Richenda van Leeuwen and other friends, set up Project Bo to raise £100,000 and build a reliable solar/battery power supply for the unit.

Scroll forward to 2019, and you can read a blog by Dr Conroy about the impact of Project Bo. In summary, mortality is down by around 40%, even though the unit now looks after many more babies. Project Bo may be saving up to eight lives per month, making it one of the most cost-effective life-saving interventions you could wish to see.

It has not all been plain sailing. There are many lessons to be learned, as you can read in a piece I wrote for the UN Foundation, Project Bo: Saving lives in Sierra Leone with solar, batteries and Twitter in May 2019. The learning continues to this day: with no data on grid reliability in Sierra Leone, we designed the system to work off-grid. But since the grid does work, even if intermittently, the batteries were not cycled deeply enough and have degraded; we now need to upgrade them at a cost of £11,000. And we also want to build a dormitory for the mothers, many of whom have just given birth by C-section, have nowhere to stay while their babies are in the unit. If you want to contribute to this great project, please let me know.

You can hear me discuss Project Bo with the incomparable Chris Nelder on the Energy Transition Show: Episode #85 – Foreign aid for microgrids. For anyone interested peeking under the bonnet of the energy transition, Chris’s podcast is a must-subscribe.

If you want to make a donation to Project Bo for batteries, maintenance or the new dormitory, please get in touch!

Back to the menu

7. Moving Mountains – Sustainability of Mountain Communities

Eight years ago, when I first started to spend winter and summer family holidays in les Diablerets, I was struck by the fact that there was so little understanding locally about sustainability. So Ecovillages was born, as an annual conference. From the start we focused on a broad definition, including environmental, social and economic sustainability, and each year we took a different theme: energy, mobility, architecture, digitisation, climate change, communications, and so on.

Over time it became clear that mountain communities all round the world face the same challenges: climate change and local pollution, demographic changes, sub-scale agriculture, either too much or too little tourism, and a limited tax base. So last year we adopted a five-year plan to go international and we rebranded Ecovillages as Moving Mountains. You can read more about the rationale for the rebranding here: Please help us Moving Mountains!

In May 2019 I was delighted to be selected as one of the Forum des Cent – 100 movers and shakers in French-speaking Switzerland. Leading regional newspaper, Le Temps, wrote a very nice profile of me under the title Michael Liebreich invente le futur durable aux Diablerets (Michael Liebreich is inventing the future of sustainability in les Diablerets).

The theme of Moving Mountains 2020, which will place in les Diablerets on 4 September, will be finance. If you love the mountains and are reading this newsletter, you need to be there – either as an attendee, volunteer, sponsor or speaker. We are also looking for people to open local Moving Mountains chapters anywhere in the world where there are mountains.

If you want to get involved, please contact me as soon as possible, and let’s Move Mountains!

8. Angel Investing

It has been a busy year or so for my angel portfolio. 2018 ended with news of the $240 million Series H raised by Chargepoint Inc, by some distance now my biggest holding. Zeelo, Europe’s leading smart commuter coach provider, which I chair, started 2019 by closing its first £4.25 million institutional round. I also participated in a small top-up seed round in Cypher, a provider of creative coding camps for kids which has just been selected for the prestigious StartEd accelerator programme. Azuri Technologies, provider of solar rooftop systems for Africa, raised a whopping $26 million in a round led by Marubeni Corporation. Great to see all this growth and fund-raising, but at some point, an exit or two might be nice. Just saying.

I made only two new investments this year. The first was in Worldsensing, the global leader in wireless geotechnical safety monitoring of infrastructure, construction sites and mine tailing dams. If you own any physical assets which are not being digitally monitored for safety, we need to talk! The second was in an early-stage, stealth mode start-up that is using deep learning to optimise the trading of power by large, grid-connected batteries.

On a less positive note, we had to sell Pearlshare, the travel information startup I helped to incubate, for shares in a Spanish competitor. We were not on track to be market leaders, and at some point you have to cut your losses. 2019 was the earnout year, so we should soon get a final score.

Anyone interested in my own entrepreneurial journey founding and selling New Energy Finance, as well as a few thoughts on clean energy and transport, should listen to this fun episode of Uplight Illuminators: From dotcom bust to clean energy visionary.

If you are interested in any of these companies, or have investment opportunities you think I might like, let me know, and let’s build some businesses!

9. Other Topics

This update is already much longer than I had planned. I won’t list all the topics I grappled with over the past year, but I wanted to highlight just a few more important ones:

- Climate-related lawsuits. My September 2019 piece for BloombergNEF, entitled Climate lawsuits – an existential risk to fossil fuel firms?, took a deep dive into 1,380 climate-related lawsuits listed in a database maintained by the Sabin Center for Climate Change Law at Columbia Law School, spanning everything from tort to securities law. I drew out parallels and contrasts with litigation against the tobacco and asbestos industries, and the recent findings against Purdue Pharma relating to the US’s opioid crisis. My conclusion was that, as things stand, lawsuits against fossil fuel companies are a material but not existential risk.

- The Renewable Singularity. All mainstream forecasts assume that penetration of variable renewables in the electricity mix is already slowing as those resources saturate. The IEA has solar meeting just 10% of power demand by 2050, BloombergNEF’s New Energy Outlook, 25%. But is it possible to imagine scenarios in which growth is sustained at recent rates? It’s an intriguing thought: solar’s proportion of global power generation has doubled nearly nine times in the past 18 years; another seven times, and it would meet our entire current power needs; wind has doubled five times in 18 years; five more doublings and it too could meet our entire current demand. In this thought piece, Scenarios for a solar singularity, I looked at the conditions under which growth might be maintained (the question is also raised by my year-end energy piece, Peak emissions are closer than you think – and here’s why, of which more below)

- Energy Return on Energy Invested (ERoEI). This is often trotted out as a killer reason why only nuclear power could ever meet the clean energy needs of the global economy. I am far from being anti-nuclear (see above), but this has always struck me as dodgy logic; last year, I finally worked out why. Of course it’s important to get more energy back than you put into a process; but it matters whether this happens over a long period or a short one. If you compare a nuclear plant with an ERoEI of 60 over a 60-year life with a wind farm with an ERoEI of 25 over a 25-year life, they both produce one unit of energy per year for each unit invested! Using ERoEI to rule out energy technologies would be like using only cash-to-cash multiples to decide between investments, completely ignoring the time factor. I am now convinced that while ERoEI per year might be an important metric to compare potential clean energy solutions, ERoEI per se is irrelevant.

- Air quality. I have not been doing much work explicitly on air quality since providing a £5k prize for an air quality hackathon in 2015 (which was won by a fantastically tenacious start-up called Airpublic). It is a topic I continue to integrate into my analysis of the clean energy and transport transition, and it is certainly one which resonates with the public – sometimes with an immediacy that climate change cannot command.

If there is a topic you think I should be looking but am missing, tell me about it!

Back to the menu

10. The Decade Ahead

At the end of 2019, I wrote two pieces for BloombergNEF in which I laid out where I thought we might be by 2030. If you click through and read only two things from this newsletter, I would recommend these two.

In the first, Peak emissions are closer than you think – and here’s why, I explain why I expect a modest uptick in the rate of energy efficiency improvement, combined with the coming acceleration in the substitution of conventional with clean energy, and a return of the global economy to more normal growth rates, will combine to see global emissions peak and then decline by around 5% by 2030. It’s a case of the cup being perhaps a quarter full: “not enough to put us fully on track to avoid appalling climate change impacts, and by 2030 we will have to admit 1.5C is out of reach. But it will be a game-changer: it will demonstrate to even the most pessimistic that we can bend the arc; it will end the feeling of helplessness and impending doom that has taken over our public discourse; and it will set us up for much more decisive reductions in the subsequent decades.”

My second year-end forecast piece, Climate Wars Episode IV – a new hope for the 2020s, focused on climate diplomacy and science. It is impossible to predict what is going to happen in the US in the next Presidential term (see above, on politics). However, my theory is that by 2030 climate diplomacy will end up in approximately the same place in any case: no dramatic new global climate deals, but steady progress in building the required global institutions and in public understanding of the need to move to a net-zero emission global economy.

One controversial discussion in which I have been involved in 2019 has been over the framing of the IPCC’s most extreme climate scenario, RCP8.5, as business-as-usual. Despite being an open secret for years in energy modelling circles that RCP8.5 is wildly implausible, few in the wider energy and climate finance community were aware of this, so I made the decision to bring it to their attention by creating a provocative twitter hashtag, #RCP85isBollox.

What may seem, on the surface, a wonkish debate, in fact has huge implications for the politics of climate change in the coming decade. The problem, as I explain in this twitter thread, is that the IPCC, in its fifth Assessment Report in 2014, designated RCP8.5 as its only official no-mitigation baseline, and placed it centre stage. As a result, there are now thousands of peer-reviewed papers referring to RCP8.5 as business-as-usual; almost every media story on impacts of climate change in the second half of the century is based on RCP8.5.

But RCP8.5 is not just nowhere near business-as-usual, it is not even plausible. Reaching it would require global thermal coal production to expand by a factor of 10 by 2100 (it is, in fact, stagnant), and there are no carbon feedbacks I have seen in the literature that could deliver the missing emissions within the next 80 years. We are simply not headed towards the 5.9C of warming by 2100 which is the extreme end of RCP8.5, still less the 7.4C extreme end of SSP5-8.5 (the scenario which will replace RCP8.5 in the next big IPCC Assessment Report in 2022. By using an extrapolation of the IEA’s Stated Policies and Current Policies scenarios we see that we might be headed for 2.7 to 2.9C of warming by 2100, with a worst case of 4.3C. And as you may recall, I have repeatedly called out the IEA’s forecasts for being overly pessimistic, so if I were forced to pick a number, I would say we are looking at 2.5C of warming by 2100, with a worst case of 3.5C.

None of this means we should be in any way complacent about climate change. As we see from the tragic bushfires in Australia, even 1C of global warming has catastrophic impacts. Quite obviously we should be redoubling our efforts to bend the curve further, to a 1.5C or 2.0C trajectory. The science on how to do that, and the need for a net-zero emissions economy is absolutely robust. My concern is that if RCP8.5 continues to be grossly misused, that climate science will eventually suffer another severe credibility crisis along the lines of Climategate. It is vital that the IPCC’s 6th Assessment Report in 2022 does not make the mistakes of the last one, or we could lose more years in the fight against climate change.

Overall, I am guardedly optimistic about the decade ahead. As I stated in those two big year-end pieces, Peak emissions are closer than you think – and here’s why and Climate Wars Episode IV – a new hope for the 2020s, I think we will see peak emissions by 2030, which “will demonstrate to even the most pessimistic that we can bend the arc; it will end the feeling of helplessness and impending doom that has taken over our public discourse; and it will set us up for much more decisive reductions in the subsequent decades.” This is a vision which I am very committed to working towards.

If you want me to come in and talk to your team, or at an event, about the decade ahead, shoot me an email!

Back to the menu

Appendix: 2019 in Figures

Note: We have been buying offsets on an ad-hoc basis to compensate for flight emissions, with many clients buying them on my behalf. However, in 2020, we would like to adopt a single offset provider – most likely doing forestry projects, but perhaps helping families in the developing world switch to clean cookstoves or LPG.

If you know of a great provider of emissions offsets we should be using, please tell us about them!

Terms of use: photos and other media may be used exclusively for the purpose of publicising an upcoming or past event involving Michael Liebreich, or to illustrate an article written by him. Their use must be accompanied by a clear indication of copyright in the following form:

© Liebreich Associates/name of photographer. Photos or other media downloaded in this way remain the property of Liebreich Associates Ltd. Any infringement of these terms of use may result in legal action by Liebreich Associates Ltd or by the respective photographer or rights holder.